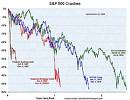

The stock market, with its volatility and general downward trend lately, has many people spooked. However, it is important to note that by choosing wise additions to your investment portfolio now, you can benefit immensely in the future. The secret is carefully researching your options and choosing value stocks.

What are value stocks?

Contrary to popular belief, value does not equal cheap. So not all value stocks are inexpensive. Some, indeed, can get rather expensive. Instead, value stocks are those that consistently offer returns, year after year. These are venerable stocks like Coca-Cola (which just reported some good earnings) and Exxon Mobil (record profits -- again), that have solid business practices and good underlying fundamentals. Value stocks are those that are most likely to survive economic slowdowns, recessions and even depressions. Why? Because many of them have already done this.

Returns on value stocks

It is important to note that returns on value stocks aren't as dramatic as the returns on growth stocks. Growth stocks may explode higher one day and then a couple days later completely implode. They are generally considered less stable. As a result, growth stocks are more affected by stock market trends. Value stocks are generally shielded from the huge swings in value. They tend to gain at a steady pace, offering modest returns of between 5 percent and 10 percent a year. They are great additions to an investment portfolio that is looking to add a little stability.

Investing in value stocks during a down market

The reason that it can be a good investment strategy to invest in value stocks during a down market is because it is possible to buy more shares at that time. When the stock market is down, nearly every company drops. A value stock that was going for $80 a share may drop to $65 or so. This is a great time to buy. You can buy up more shares for your money (especially if you are using dollar cost averaging). When the stock market recovers (as it usually does in the long run), your value stock will probably return to its $80 level eventually, and maybe even solidly plod to $85 or $90 over the course of the next several years. And you got a good portion of your shares on sale for $65! You can see how good that would be for your investment portfolio.

Of course, caution is needed. You need to make sure you are choosing solid companies that are likely to recover from the down market. Choosing the wrong company, just because it is "cheap" can mean disaster later on.

Disclaimer: I am not an investment professional. This is not investment advice. Do your own research and/or consult with a professional before making an investment decision.

stock promoters